crypto tax calculator canada

Koinly is one of Canadas most popular crypto tax calculators. We offer a free trial so you can try out our software and get comfortable with how it works.

Koinly Review For Canadians October 2022

Canada has a few tax breaks that crypto investors will be interested in.

. This would mean you pay 3300 tax on your gain of 20000. A simple way to calculate. The source data comes from a set of trade logs which are provided by the exchanges.

Koinly calculates your crypto taxes and helps you reduce your tax bill no matter if you need to report business income or a capital. What is covered in the free trial. The Canadian Revenue Agency CRA has published a detailed tax guide for the.

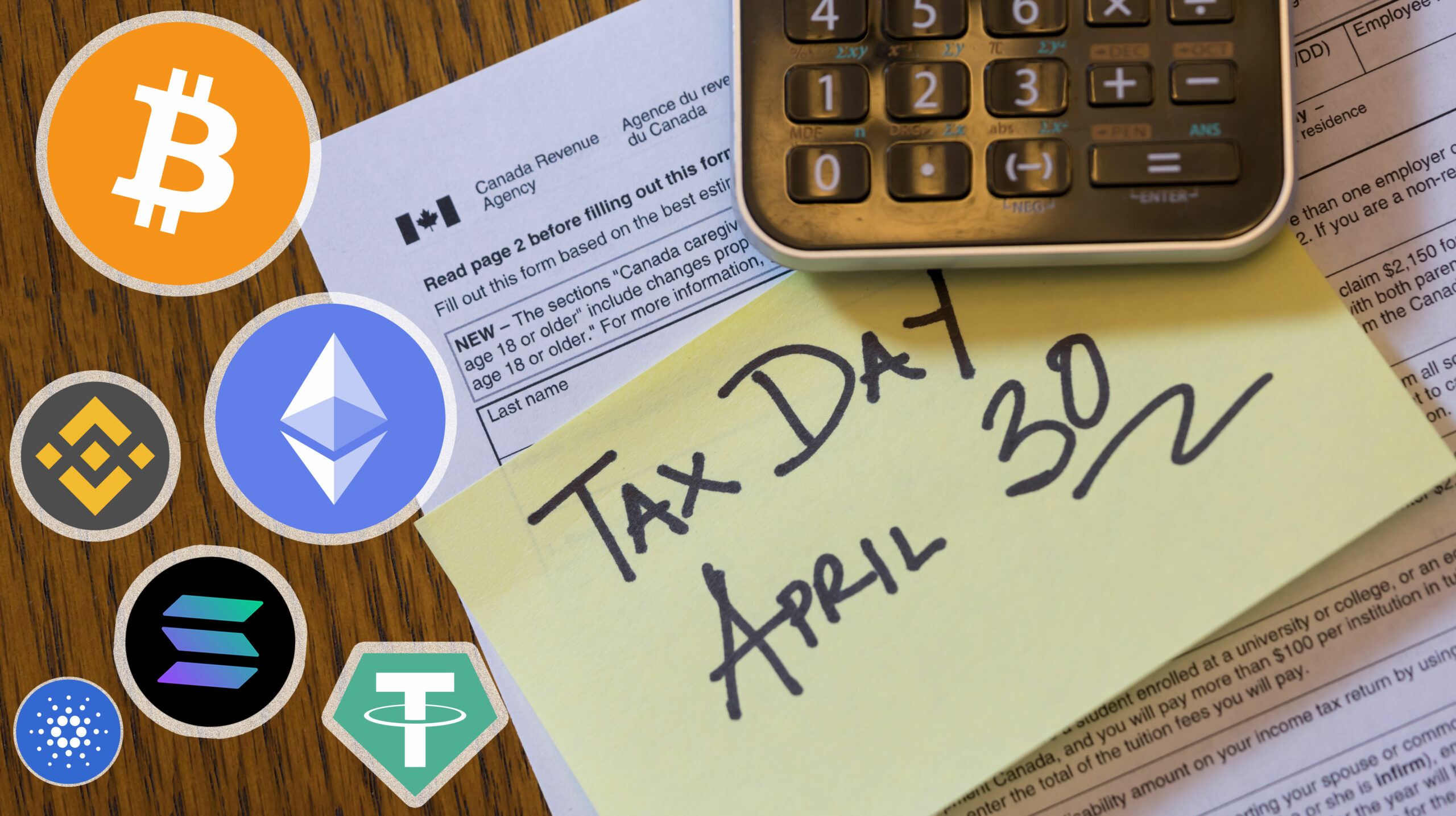

Crypto Taxes in Canada. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. It takes less than a minute to sign up.

For income tax purposes cryptocurrency isRead more. Crypto tax breaks. FMV Fair Market Value Cost Basis Capital GainsIncome Fair market value is the amount the asset or crypto is selling for.

The free trial allows you to import data review transactions. February 12 2022 by haruinvest. Heres how you calculate crypto taxes in Canada.

Remember how we said Canada taxes only. A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes. If for instance you earn 1000 through crypto trading and your tax rate is 25 youll end up with a tax bill of 125 on those funds or 25 of 500.

Only half your crypto gains are taxed. You would pay it in dollars not in crypto. Crypto Tax Calculator Plans Pricing All plans include coverage for every type of crypto transaction including but not limited to DeFi DEXs derivatives and staking as well as.

However it is important to note that only 50 of your capital gains are taxable. Adjusted Cost Base Explained. Bitcoin Tax Calculator for Canada Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance Schedule 3 Form Adjusted Cost Basis Superficial Loss.

Calculate your crypto taxes and learn how you can minimize crypto taxes for the USA UK Canada and Australia. Youll only pay Capital Gains Tax on half. Create your free account now.

Home Search results for crypto tax calculator canada How to Calculate Capital Gains on Cryptocurrency. On the crypto transaction of 20000 you will pay tax on 10000 at a rate of 33. However it is important to note that only 50 of your capital gains are taxable.

Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. By sdg team Tax. Crypto Tax Calculator.

Bitcoin And Crypto Taxes Frequently Asked Questions

How Do I Manually Report My Cryptocurrency Gains Or Losses Help Centre

Best Crypto Tax Calculator Canada In 2022 Skrumble

Koinly Review Our Thoughts Pros Cons 2022

Koinly Review What You Need To Know About This Crypto Tax Calculator

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Calculate Your Crypto Taxes Using The Formulae Below Or Simply Use My Automated Software Hackernoon

Cryptoreports Google Workspace Marketplace

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

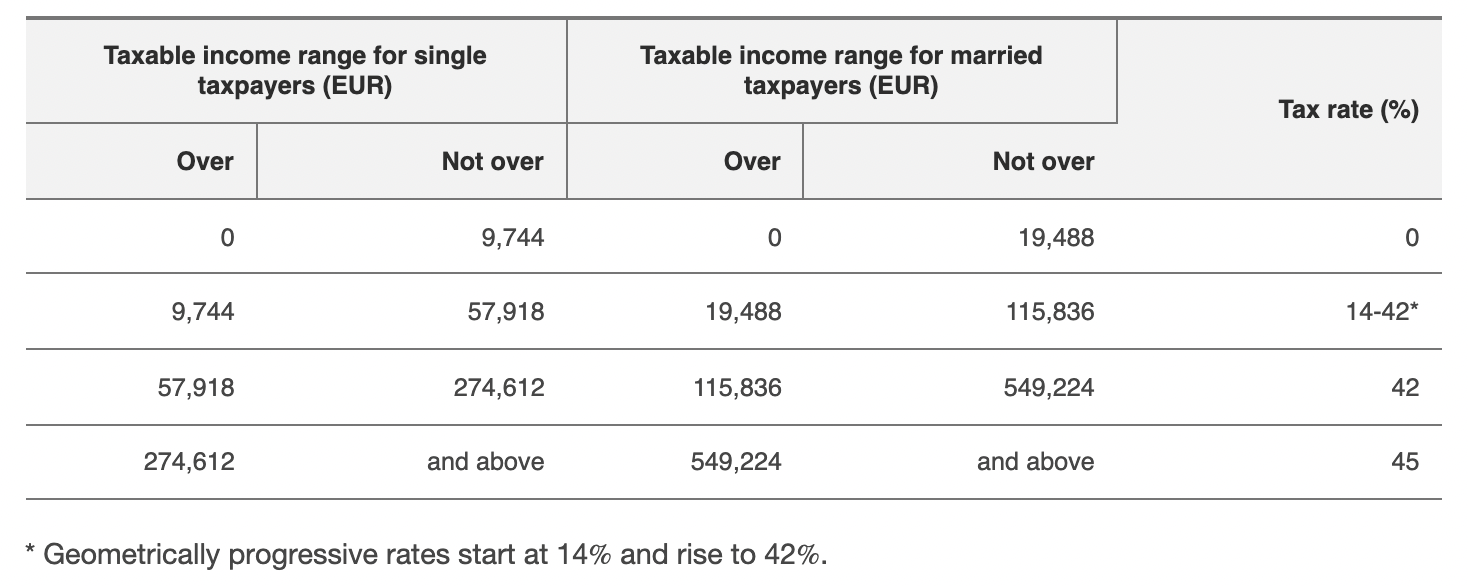

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

Cryptocurrency Tax Calculator The Turbotax Blog

How To Report Crypto Taxes In 2022 Crypto Tax Calculator Sweden And Works In 35 Countries Airlapse

9 Best Crypto Tax Software Apps 2022

Here S A Quick Guide To Filing Crypto Taxes In Canada

Free Crypto Tax Calculators 2022 Calculate Your Bitcoin Taxes For Free